Dear Adrian

Thank you for your email regarding the National Rental Affordability Scheme (NRAS).

In the 2013-14 NRAS year, the Department identified a range of compliance issues resulting in a delay in the issuing of incentives for that year. The Department is taking advantage of the lessons learned from the 2013-14 NRAS year to ensure a smoother processing period for the 2014-15 year. It is important to note, that the issuing of incentives for 2014-15 remains dependent upon approved participants meeting the compliance framework.

For the 2014-15 NRAS year, approved participants have been directed to advise the Department when all their Statements of Compliance are ready to be assessed, and have been provided with a checklist to guide their preparations. Further, the due date for lodging Statements of Compliance was extended from 30 June 2015 to 14 August 2015 to allow approved participants additional time to lodge their Statements of Compliance.

Far too many investment decisions in Australian real estate are driven by herd mentality and FOMO (Fear Of Missing Out). But it helps to explain why most Australians who attempt property investment have a bad experience.

Far too many investment decisions in Australian real estate are driven by herd mentality and FOMO (Fear Of Missing Out). But it helps to explain why most Australians who attempt property investment have a bad experience.

When people are driven by an impulse to do what others are doing (the herd mentality) or to get in because they don’t want to miss all that lovely capital growth they keep hearing about (FOMO), they can only be buying well after the boom started.

Few people ever got rich following the masses. Some will have succeeded by leading the masses, but the truly successful people are more often those who run in the opposite direction.

Driven by either lack of confidence or lack of understanding, both the 'herd mentality' and FOMO are the cause for most people buying when prices are high.

Conversely, when the market is down, they stay out of the market. They’ll get back in when they read that 'the herd' is running again... Madness!

The board of the Reserve Bank of Australia today decided to keep the Official Cash Rate at 2% unchanged for a seventh straight month - Which given the impact of APRA's recommendations and the subsequent slowing volumes of sales there is no surprise there.

The RBA has signalled that the cash rate will remain on hold for the foreseeable future. The RBA has also signalled that if there is to be any change in 2016 it will be a further reduction. The next meeting of the Reserve Bank Board is not until February 2 2016.

Call 1300 67 27 to find out what difference APRA's (Australian Prudential Regulation Authority), recommendations to lenders have made to individuals looking for a mortgage facility

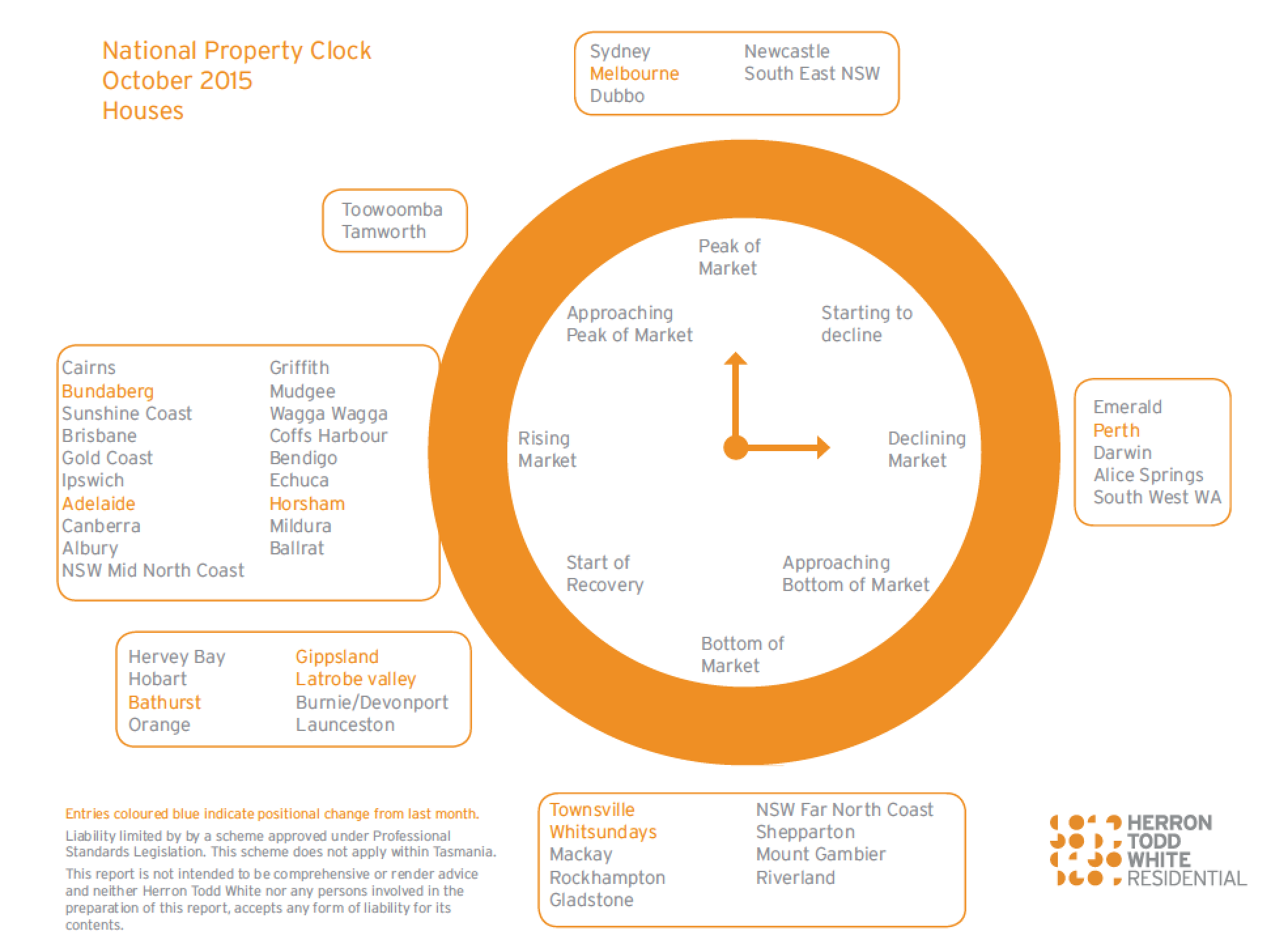

Herron Todd White - Property clock - October 2015 - Houses

Markets are a complex beast made up of many facets – and not all sectors rocket along at the same pace. It’s important to not only know how real estate is performing overall in a region, but to understand what particular part of that market is performing best.

Looking for the house and land opportunity? Talk to InvestorGroup and find out more about areas of interest and researched opportunity. 1300 67 27 28

Or register your interest in the form on the right, and one of our team will contact you at a convenient time for you.

Herron Todd White (HTW), the largest independent property valuer in country released it's October 2015 property clock.

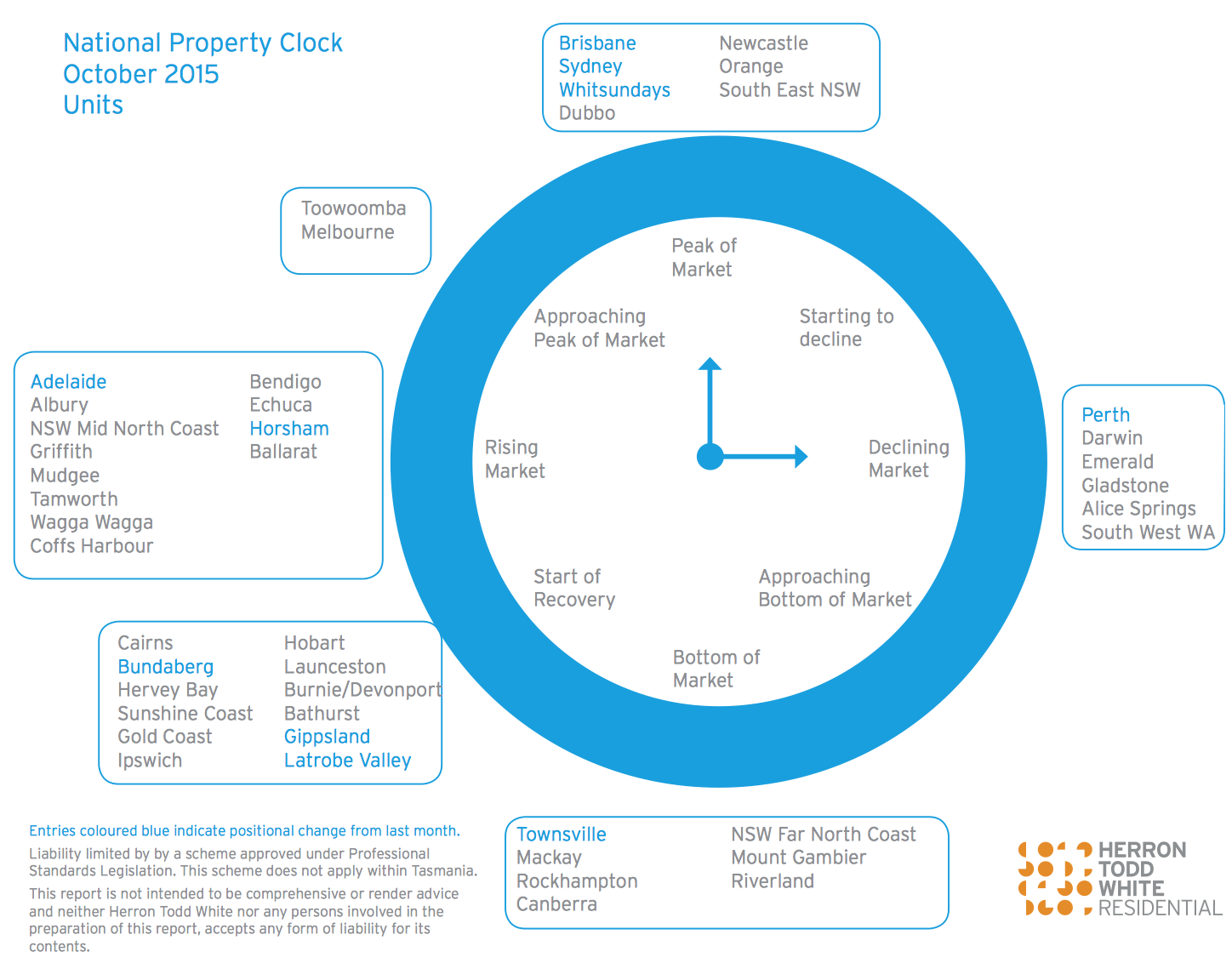

Herron Todd White - Property clock - October 2015 - Units

There’s one thing we should all realize about property markets - they aren’t simple. Granted there’s things like ‘herd mentality’ and FOMO that make the art of predicting price movements a bit more comfortable, but the myriad of property types, price points and localities that combine under the single term ‘Local property market’ demand scrutiny.

Talk to InvestorGroup and find out more about areas and researched opportunities. 1300 67 27 28

Herron Todd White (HTW), the largest independent property valuer in country released it's October 2015 property clock

1300 38 66 34

1300 38 66 34