First-home buyers.

The Government’s new scheme, which will allow eligible first-home buyers to get a mortgage with only a 5 per cent deposit, will kick off in January 2020.

The government unveiled the latest details of its scheme end October, confirming that 10,000 applicants would be chosen on a first-in, best-dressed basis.

But first-home buyers wanting to use the federal government’s new first home loan deposit scheme will be forced to buy homes in areas well outside of expensive cities, particularly in Sydney and Melbourne.

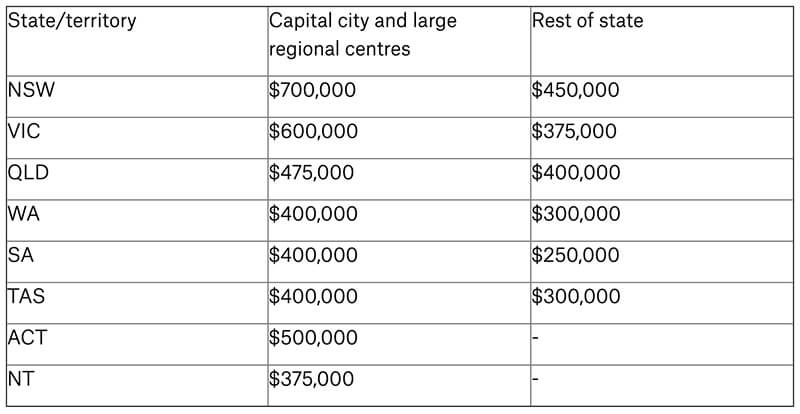

It also revealed the price caps for every capital city, large regional centres with a population over 250,000 and regional areas across the country.

The mortgage thresholds differ depending on the state and regional centre, with first-home buyers in Sydney limited to a loan of $700,000 or less, Melbourne to $600,000 or less, Brisbane $475,000 or less and Perth $400,000 or less.

The State thresholds are listed below

Eligibility criteria Applicants under the Scheme will be subject to eligibility criteria, including criteria in relation to income thresholds and property prices. The income thresholds will be up to $125,000 per annum for singles and up to $200,000 per annum combined for couples (assessed in the financial year preceding the financial year in which the loan is entered into). The Scheme will apply to owner-occupied loans on a principal and interest basis.

Download the first home buyer loan deposit scheme fact sheet here

1300 38 66 34

1300 38 66 34