Moody’s Analytics, a leader in risk measurement and management, and CoreLogic, Australia’s leading property data, analytics and market insights company, forecast that home value growth will likely slow across Australia in 2016, following two years of exceptional home value appreciation and double-digit growth in many areas.

Moody’s Analytics, a leader in risk measurement and management, and CoreLogic, Australia’s leading property data, analytics and market insights company, forecast that home value growth will likely slow across Australia in 2016, following two years of exceptional home value appreciation and double-digit growth in many areas.

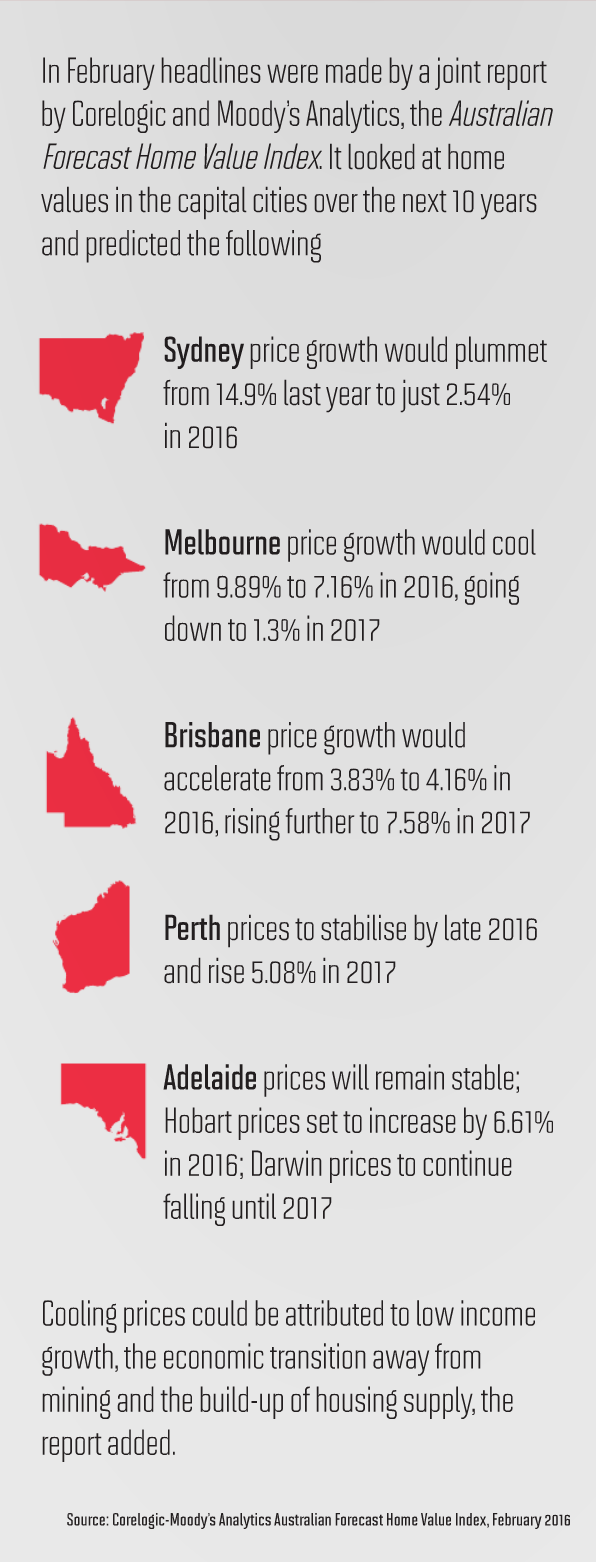

This forecast is based on the new CoreLogic-Moody’s Analytics Australian Forecast Home Value Index, launched today, which provides a quarterly projection of the trend of residential home values across the country over the next 10 years. Forecasts are updated monthly to help market participants identify opportunities and manage risk exposures.

“We are excited to partner with Moody’s Analytics to launch this Forecast Index to provide a unique and critical perspective on Australia’s most valuable asset class, currently valued in excess of $6.4 trillion AUD,” said Craig Mackenzie, CoreLogic EGM, Banking & Finance.

“On the outlook for the housing market nationally, we expect house price appreciation to slow in 2016. Our forecast reflects lower income growth as the Australian economy transitions away from mining-related investment, as well as the strong build-up of housing supply over the past two years,” said Alaistair Chan, a Sydney-based economist based at Moody’s Analytics.

“Nevertheless, accommodative policy, robust rental growth, and a recovering labour market are expected to support valuations over the medium term,” adds Chan. The CoreLogic-Moody’s Analytics Australian Forecast Home Value Index currently includes forecasts at a capital city and rest-of-state level.

“Conditions in Melbourne are again expected to outperform Sydney this year, with values forecast to rise by 7.2% in 2016, before slipping back to just 1.3% growth in 2017,” said CoreLogic research director Tim Lawless.

While the pace of house price appreciation is forecast to slow in Sydney, Melbourne and Darwin this year, there is expected to be some pick-up in growth in the remaining capital cities. Hobart, in particular, stands out for better price growth.

For more see article on Corelogic

1300 38 66 34

1300 38 66 34