Market and economic outlook

“While we may celebrate the strength in the market, we also need to be cognisant that it’s still a market with challenges, as well as opportunities.” - Deloitte Financial Services partner and report co-editor James Hickey

“While we may celebrate the strength in the market, we also need to be cognisant that it’s still a market with challenges, as well as opportunities.” - Deloitte Financial Services partner and report co-editor James Hickey

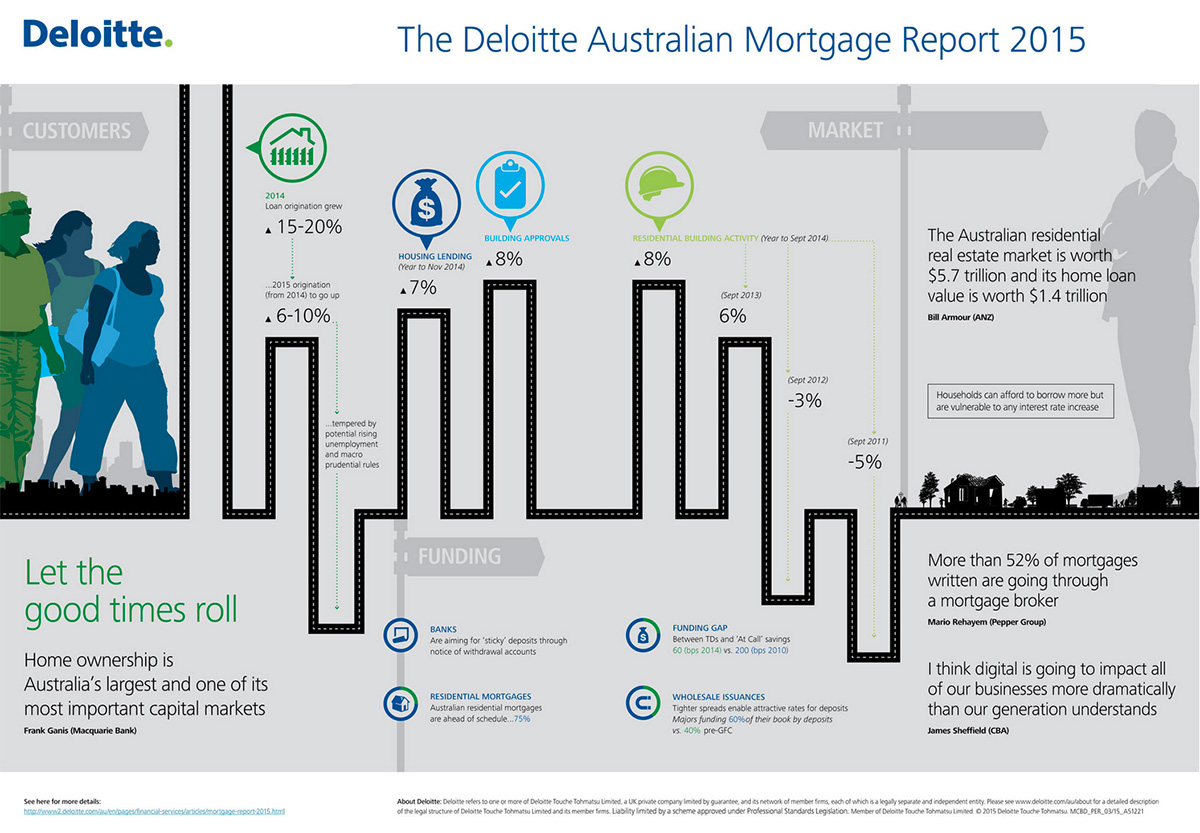

Worth $1.4 trillion in our $5.7 trillion residential real estate market, home loans are one of Australia’s largest and most important capital markets. Given the strong tailwinds from last year’s 20% growth in loan settlements, and the current historically low interest rates, how sustainable is this level of loan origination in 2015? Watch the video

Deloitte Financial Services partner and report co-editor James Hickey said: “Before the 20% growth in 2014, there were some years where settlement volumes struggled, particularly in 2010 to 2012. So what we saw last year was largely due to pent up demand from existing home owners to upgrade, refinance or restructure.”

He said: “Settlements across Australia on a monthly basis in 2014 averaged $28 billion with a monthly record of $33 billion in December. That is the highest single monthly settlement rate on record, and a clear jump since the onset of the GFC, when settlements struggled to reach $20 billion."

Deloitte 2015 Mortgage Report - Let the good times roll

In Summary:

- Growth dynamics are solid

- Existing borrowers will remain the source of most lending activity (as upgraders/refinancers)

- First home buyers a structural issue, but they are innovating to get into the market as first home investors

- Margins and performance will remain solid for majors

- But non-majors still challenged on margin sustainability and scale

- Technology is rapidly evolving and driving innovation and simplicity

- Omni-channel experience in the mortgage process needs to be a reality

- Digital will change the way mortgages are being offered, for lenders and brokers

- How and when to access fintechs is a key questions for majors

“If house price growth does moderate over the next few months, either by the RBA’s discussions or just running out of steam, there will be far less pressure for interest rates to rise in 2015. However at present it’s a case of ‘let the good times roll’ for those in the property market,” said Hickey.

1300 38 66 34

1300 38 66 34